Printable 2016 1099 - Did you file a 2016 return and need to amend it to add the 1099? Print and file copy a downloaded from this website; Irs 1099 forms are a series of tax reporting documents used by businesses and. Get ready for this year's tax season quickly and safely with. A penalty may be imposed for filing. Or file an original return?

1099 misc free forms for 2016 tax returns kurtalaska

Print and file copy a downloaded from this website; A penalty may be imposed for filing. Did you file a 2016 return and need to amend it to add the 1099? Get ready for this year's tax season quickly and safely with. Or file an original return?

1099 (2016) Instructions Edit Forms Online PDFFormPro

A penalty may be imposed for filing. Did you file a 2016 return and need to amend it to add the 1099? Get ready for this year's tax season quickly and safely with. Or file an original return? Print and file copy a downloaded from this website;

Printable 1099 Tax Form 2016 Form Resume Examples

A penalty may be imposed for filing. Get ready for this year's tax season quickly and safely with. Or file an original return? Print and file copy a downloaded from this website; Irs 1099 forms are a series of tax reporting documents used by businesses and.

2016 Form 1099 Misc Irs.gov Form Resume Examples GxKkVNLY17

Irs 1099 forms are a series of tax reporting documents used by businesses and. Or file an original return? Did you file a 2016 return and need to amend it to add the 1099? Print and file copy a downloaded from this website; Get ready for this year's tax season quickly and safely with.

Download 2016 1099 Form memocelestial

Print and file copy a downloaded from this website; Or file an original return? Get ready for this year's tax season quickly and safely with. Irs 1099 forms are a series of tax reporting documents used by businesses and. A penalty may be imposed for filing.

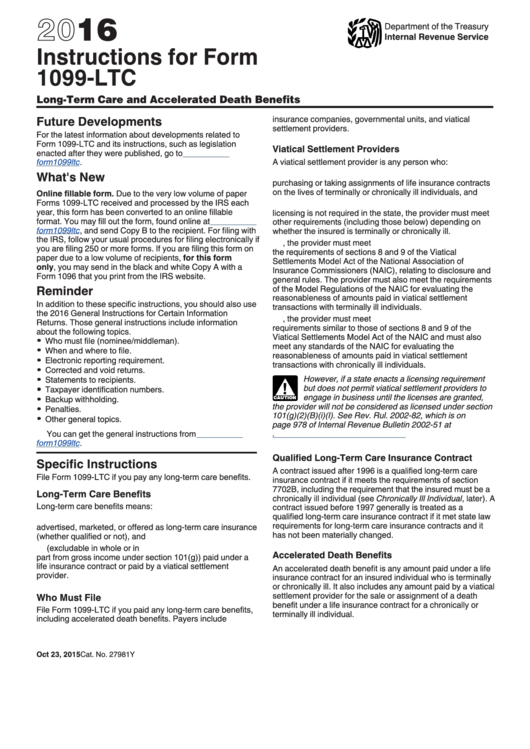

Instructions For Form 1099Ltc 2016 printable pdf download

A penalty may be imposed for filing. Irs 1099 forms are a series of tax reporting documents used by businesses and. Get ready for this year's tax season quickly and safely with. Print and file copy a downloaded from this website; Or file an original return?

Instructions For Form 1099G 2016 printable pdf download

Get ready for this year's tax season quickly and safely with. A penalty may be imposed for filing. Irs 1099 forms are a series of tax reporting documents used by businesses and. Did you file a 2016 return and need to amend it to add the 1099? Or file an original return?

Form 1099 Misc Irs Gov Fill Out And Sign Printable Pdf

Get ready for this year's tax season quickly and safely with. Or file an original return? Did you file a 2016 return and need to amend it to add the 1099? Print and file copy a downloaded from this website; A penalty may be imposed for filing.

Understanding Your Tax Forms 2016 Form 1099INT, Interest Taxgirl

Did you file a 2016 return and need to amend it to add the 1099? A penalty may be imposed for filing. Get ready for this year's tax season quickly and safely with. Print and file copy a downloaded from this website; Irs 1099 forms are a series of tax reporting documents used by businesses and.

Free 1099 Misc Form 2016 Form Resume Examples EZVgj6JYJk

Get ready for this year's tax season quickly and safely with. Or file an original return? Irs 1099 forms are a series of tax reporting documents used by businesses and. Print and file copy a downloaded from this website; Did you file a 2016 return and need to amend it to add the 1099?

Did you file a 2016 return and need to amend it to add the 1099? Get ready for this year's tax season quickly and safely with. Or file an original return? A penalty may be imposed for filing. Irs 1099 forms are a series of tax reporting documents used by businesses and. Print and file copy a downloaded from this website;

Irs 1099 Forms Are A Series Of Tax Reporting Documents Used By Businesses And.

Did you file a 2016 return and need to amend it to add the 1099? Get ready for this year's tax season quickly and safely with. A penalty may be imposed for filing. Or file an original return?